Cynthia Bailey has been accused of failing to pay taxes for nearly a decade. While he’s spent years defending his character and finances, he’s finally speaking out and coming clean.

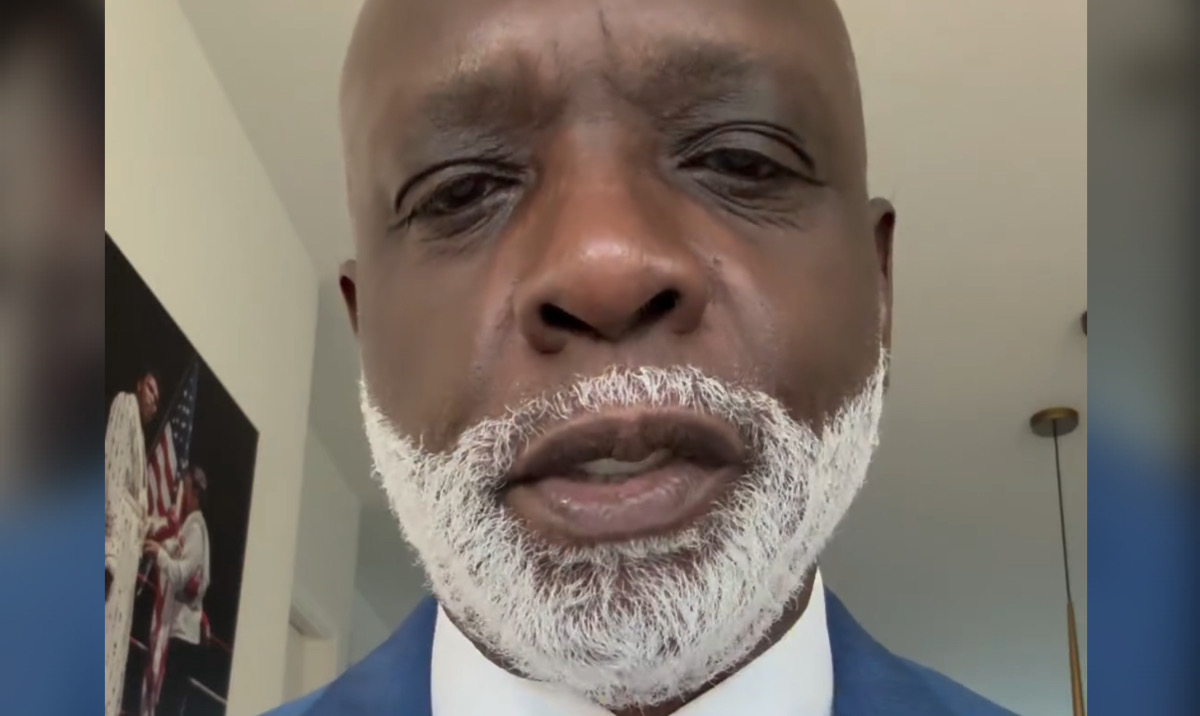

On Monday, the former Real Housewives of Atlanta star posted a video to his official Instagram account where he first apologized to his family and friends for simply being irresponsible. He began saying, “I’ve did some wrong that I have to make right. I have to stand up, I have to be accountable, I have to be responsible and I have to pay my debt.”

Mr. Thomas went on to admit, “From one struggling business to the next, I failed to pay my withholding taxes on time. And at some point, when the business wasn’t doing well, failed to pay at all. It’s something that I thought I could work out, catch up with, make whole. But then the hole got deeper for me.” Thomas has been dealing with financial issues ever since opening up his restaurant Sports One in 2014. According to the Notice of Federal Tax Lien, Sports ONE CLT LLC $236,952.51 in unpaid taxes at one point and was ultimately shut down. Mr. Thomas was also slapped with a $9 million judgment for unpaid rent for his Miami business, Bar One. While continuing to own up, Thomas continued saying,

“I deeply regret, deeply, and I’m saying this with all sincerity, I deeply regret [not making] the IRS withholding taxes a priority in my life. With no excuses because there is none. It’s the law. And I’m finding out a lot about that law lately.”

RELATED:Sukihana Continues To Go Off On Peter Thomas After He Criticized Her For Dancing With One-Legged Man

RELATED:Peter Thomas Found Not Guilty After Being Accused Of Choking Tammy Rivera’s Niece; Tammy Responds

What Happens When You Don’t Pay Your Taxes As A Business Owner?

When a business owner neglects to pay their taxes, it can result in various consequences. These consequences can vary depending on the jurisdiction and the severity of the non-payment. Generally, the repercussions of not paying taxes as a business owner include penalties and interest, tax liens on assets, potential seizure of assets, legal action, loss of business license, and damage to the business’s reputation.

Furthermore, penalties and interest can accumulate, making the tax debt significantly larger. Tax liens can be placed on the business’s assets, hindering the owner’s ability to sell or transfer property. In extreme cases, the tax authorities may seize assets to satisfy the unpaid debt. Legal action, such as lawsuits and wage garnishment, can be taken against the owner. Non-payment can also lead to the revocation of the business license, rendering it illegal to operate. Additionally, the business’s reputation and credibility may suffer… which it did for Thomas.

Taking this as a major learning lesson, Mr. Thomas went on to share a message to other business owners:

“Make sure you can cover all those withholding taxes. Make sure on the 20th of every month you pay those revenue taxes. When those things add up, Uncle Sam is your partner. They’re not getting their piece, it keeps on adding up, it’s gonna come and it’s gonna bite you.”